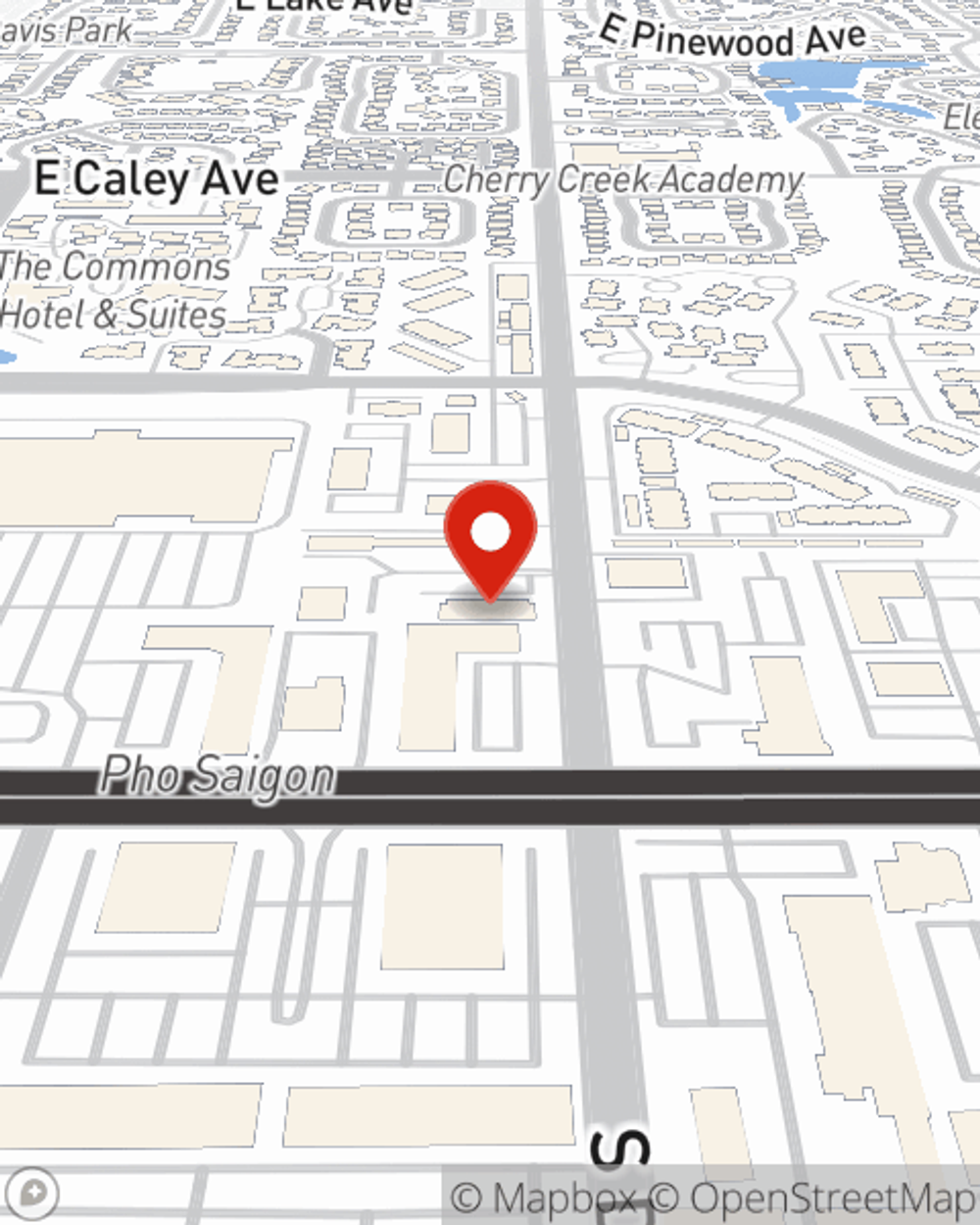

Business Insurance in and around Greenwood Village

One of the top small business insurance companies in Greenwood Village, and beyond.

This small business insurance is not risky

- Greenwood Village

- Centennial

- Denver

- Denver Tech Center

- Highland Ranch

- Castle Rock

- Castle Pines

- Parker

- Englewood

- Pine

- Arapahoe County

- Douglas County

- Lone Tree

- Aurora

- Lakewood

- Boulder

- Evergreen

- Thornton

- Colorado Springs

- Broomfield

- Golden

- Fort Collins

- Littleton

- Arvada

Your Search For Fantastic Small Business Insurance Ends Now.

When you're a business owner, there's so much to take into account. You're in good company. State Farm agent Beth Bales is a business owner, too. Let Beth Bales help you make sure that your business is properly protected. You won't regret it!

One of the top small business insurance companies in Greenwood Village, and beyond.

This small business insurance is not risky

Surprisingly Great Insurance

If you're looking for a business policy that can help cover business property, equipment breakdown, and more, State Farm may be able to help, just like they've done for other small businesses since 1935.

At State Farm agent Beth Bales's office, it's our business to help insure yours. Get in touch with our terrific team to get started today!

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Beth Bales

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.